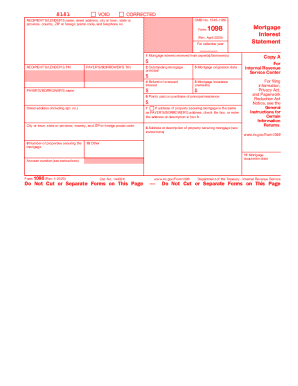

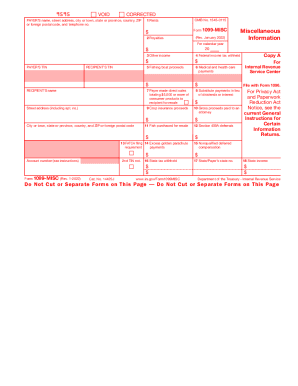

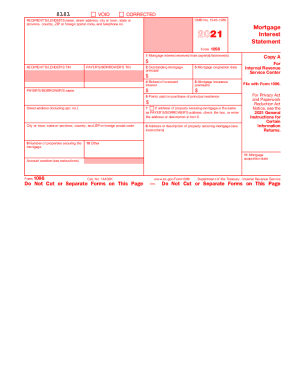

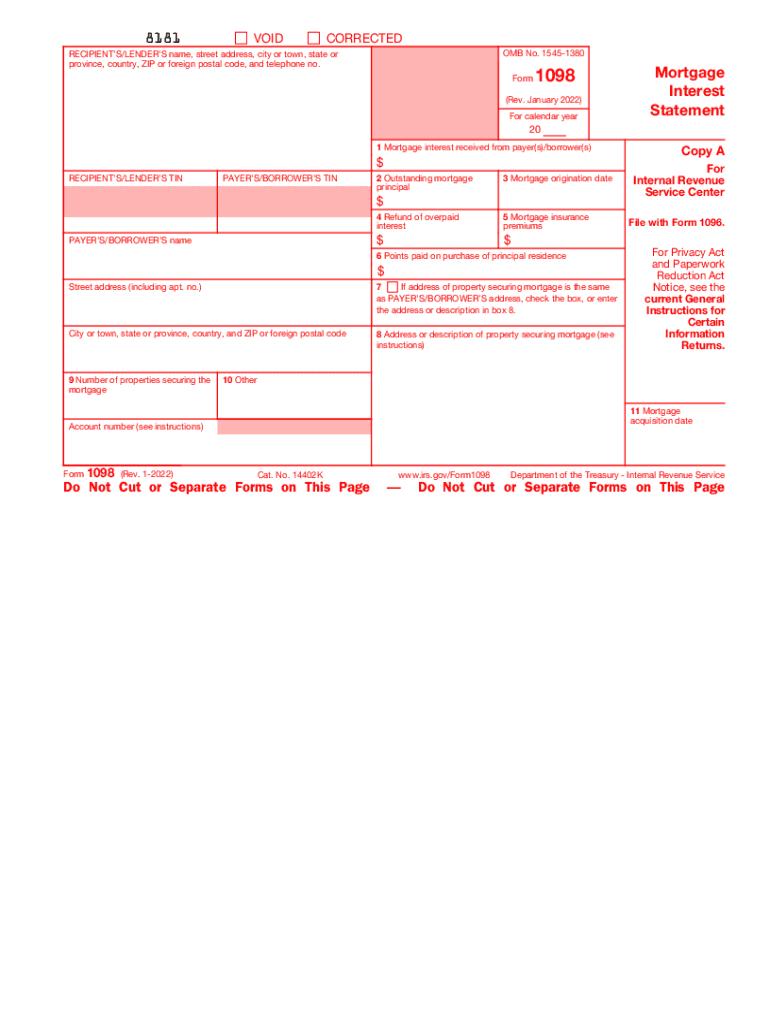

IRS 1098 2022 free printable template

Instructions and Help about 1098

How to edit 1098

How to fill out 1098

Latest updates to 1098

All You Need to Know About 1098

What is 1098?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1098

What should I do if I notice a mistake on my submitted 1098 form?

If you find an error on your 1098 form after submission, you can correct it by filing an amended 1098. It's important to carefully review the specific guidelines provided by the IRS for amendments, ensuring you include the correct information and proper documentation. Keep in mind that certain deadlines may apply when submitting corrections.

How can I verify the status of my 1098 submission?

To check the status of your 1098 submission, you can contact the IRS or use their online resources. It's crucial to keep track of any confirmation numbers or documentation provided at the time of submission, as this will aid in verifying whether your form has been processed or if there were any issues.

What are common errors people make when filing a 1098 and how can I avoid them?

Common errors during the 1098 filing process often include incorrect taxpayer identification numbers, wrong payment amounts, or failing to send the necessary copies to all required parties. To avoid these mistakes, double-check all information before submission and consult available resources or professionals if you have uncertainties.

How long should I retain records related to my 1098 form?

It is advisable to retain records related to your 1098 form for at least three years after the tax year in which you filed it. This is essential for reference during any potential audits or discrepancies. Additionally, ensure that your data is kept secure to maintain privacy.

What if I receive a notice regarding my 1098 submission?

If you receive a notice or letter from the IRS concerning your 1098 submission, it's vital to read it thoroughly and respond promptly. Gather any necessary documentation and prepare to address the issues raised in the notice. Seeking assistance from a tax professional can also be beneficial in navigating the response process.

See what our users say