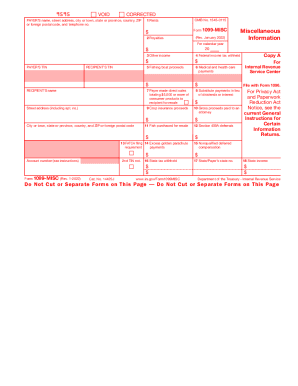

IRS 1098 2022-2025 free printable template

Show details

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red,

similar to the official IRS form. The official printed version of Copy A of this IRS form is

scalable,

pdfFiller is not affiliated with IRS

Instructions and Help with form

How to edit fillable 1098

How to fill out

Video instruction

Instructions and Help with form

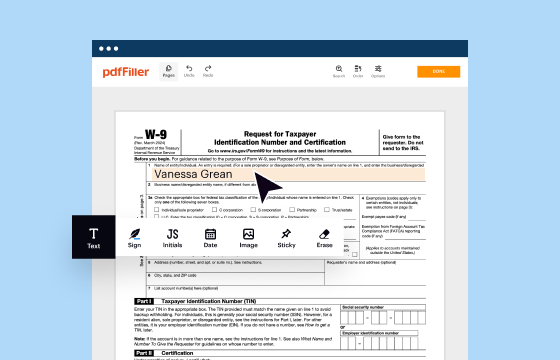

Manage and handle 1098 mortgage interest forms online.

How to edit fillable 1098

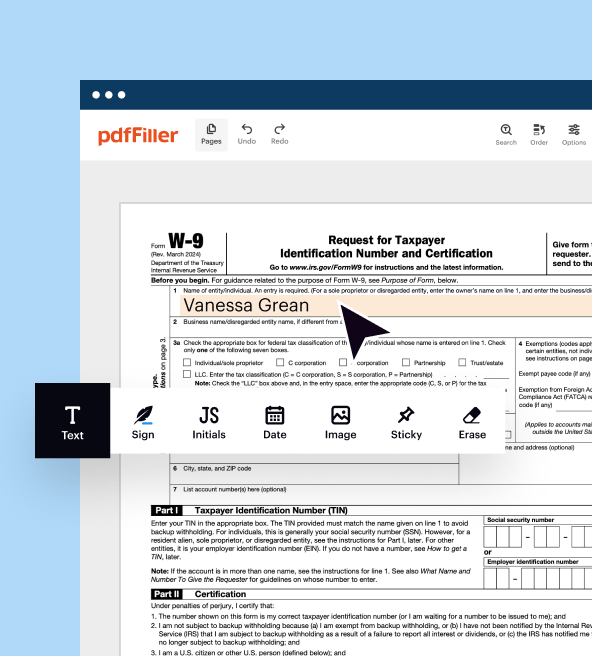

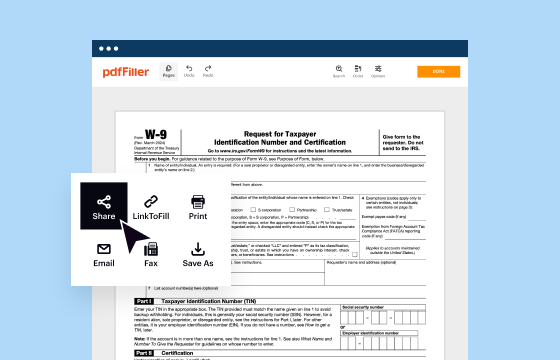

Follow these steps to edit blank 1098 form with our online PDF editor:

01

Log in or register a free pdfFiller account to start using our online editor.

02

Upload the 1098 template from your device or cloud storage.

03

Edit 1098 and add more fillable fields, images, comments, and other elements if necessary.

04

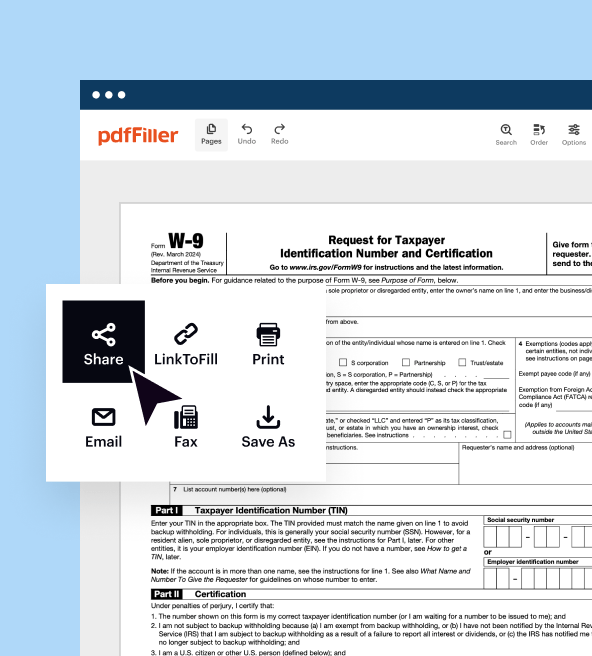

Share and send your form right to the IRS or download and print it.

How to fill out

Simplify IRS form 1098 completion with these steps:

01

Start by gathering all the necessary information, such as your name, address, and taxpayer identification number.

02

Fill in the recipient's information, including their name, address, and taxpayer identification number.

03

Indicate the amount of mortgage interest received by the recipient during the tax year.

04

Report the amount of real estate taxes paid on behalf of the recipient.

05

Include any points paid on the mortgage, if applicable.

06

Provide the name, address, and taxpayer identification number of the lender.

07

Review the form for accuracy and make any necessary corrections.

08

Sign and date the form before submitting it to the appropriate party.

Video instruction

Show more

Show less

New Updates to Form 1098

Updated Reporting Threshold

Instructions for Multiple Borrowers

Changes in Exceptions

Penalties and Compliance

Future Developments

New Updates to Form 1098

The IRS has updated its guidelines for Form 1098, highlighting the changes in reporting mortgage interest and addressing further specificities:

Updated Reporting Threshold

The threshold for reporting mortgage interest has been adjusted. This update pertains primarily to individuals and sole proprietors, who must now report if they receive $600 or more per annum in mortgage interest.

Instructions for Multiple Borrowers

In case of multiple borrowers, there are updates on how to divide the mortgage interest among them accurately, ensuring no borrower is taxed unfairly.

Changes in Exceptions

The updates have also redefined the exceptions to filing. The exceptions now include credit card obligations and interest received from a corporation, partnership, trust, estate, or association.

Penalties and Compliance

If you are required to file electronically but fail to do so without an approved waiver, a penalty may apply unless you can show reasonable cause. For most forms, the penalty can reach $330 per form filed late electronically, though it applies only to the extent that more than 10 returns are filed. This penalty does not apply separately to original and corrected returns.

Future Developments

The IRS notes that further modifications might be made to Form 1098 in the future. For the latest developments, taxpayers are advised to frequently visit the IRS website.

Show more

Show less

All You Need to Know About 1098 Tax Form

What is IRS Form 1098?

What is the purpose of the fillable 1098?

Who needs to file Form 1098 (mortgage interest statement) 2025?

What other documents must accompany the IRS form 1098?

When is the IRS Form 1098 due?

Where do I send Form 1098?

What are the components of 1098 template?

Who should file the IRS form 1098?

When is the form due date?

All You Need to Know About 1098 Tax Form

Get ready for 2025 tax season with pdfFiller: learn everything you need to know about printable 1098 tax forms and more!

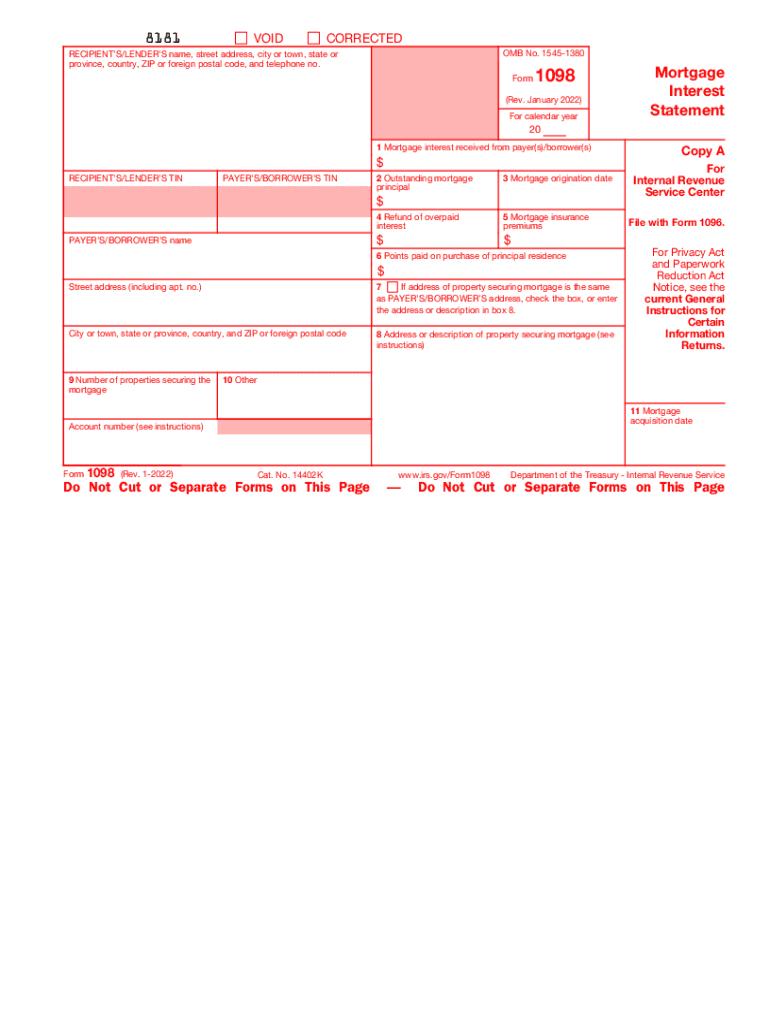

What is IRS Form 1098?

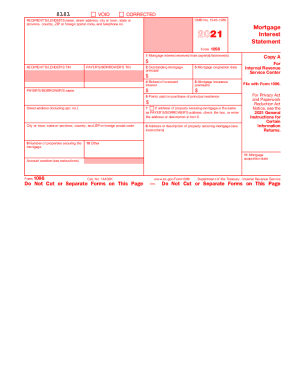

Form 1098 is used to report mortgage interest of $600 or more that you, in the course of your trade or business, received from an individual, such as a sole proprietor, during the year. This form is typically provided by lenders to borrowers and the IRS to report the amount of interest paid on a mortgage.

What is the purpose of the fillable 1098?

The Form 1098, according to the IRS guidelines, is also known as the "Mortgage Interest Statement." Its primary use is to report mortgage interest of $600 or more received during the year in the course of trade or business from an individual, including a sole proprietor.

Who needs to file Form 1098 (mortgage interest statement) 2025?

File the 1098 Form if you are engaged in a trade or business and, in the course of such trade or business, you receive from an individual $600 or more of mortgage interest on any one mortgage during the calendar year. You are not required to file this form if the interest is not received in the course of your trade or business. For example, if you hold the mortgage on your former personal residence and the buyer makes mortgage payments to you. In this case, you are not required to file this Property Tax Form 1098.

What other documents must accompany the IRS form 1098?

There are three copies of the mortgage interest statement, copies A, B, and C. Copy A of the form is submitted to the IRS. Copy B of the form is issued to the payer/borrower, and copy C of the form is for the lender’s records. Form 1098 has to be accompanied by Form 1096, which is a transmittal form.

When is the IRS Form 1098 due?

The copy B of Form 1098 must be furnished to the payer by the 31st of January 2025.

Copy A is to be filed with the IRS by February 28, 2025 (paper) or March 31, 2025 (electronic).

Where do I send Form 1098?

You may not need to submit a 1098 form with your tax return. Copy B of IRS Form 1098 mortgage interest statement form must be provided to the payer, and Copy A of this form must be filed with the IRS.

What are the components of 1098 template?

Completing the 1098 form is simple:

The left side of the form reflects information relating to the lender and the borrower.

The right side of the form (boxes 1-6) reflects information relating to the mortgage interest received from the borrower (Box 1), outstanding mortgage principal as of January 1st (Box 2), mortgage origination date (Box 3), refund of overpaid interest (Box 4), mortgage insurance premiums (Box 5), and points paid on the purchase of principal residence (Box 6).

Boxes 7-9 relate to the property and the address that is securing the mortgage.

Who should file the IRS form 1098?

File the 1098 Form if you are engaged in a trade or business and, in the course of such trade or business, you receive from an individual $600 or more of mortgage interest on any one mortgage during the calendar year. You are not required to file this form if the interest is not received in the course of your trade or business. For example, if you hold the mortgage on your former personal residence and the buyer makes mortgage payments to you. In this case, you are not required to file this Property Tax Form 1098.

When is the form due date?

The IRS requires that Form 1098 (mortgage interest statement) be provided to recipients by January 31 and filed with the IRS by February 28 if filing on paper or by March 31 if filing electronically. For complete details, see the official IRS Instructions for Form 1098.

Show more

Show less

FAQ

How can pdfFiller help me with my taxes?

pdfFiller streamlines the tax filing process by enabling you to fill out, edit, and securely store your tax documents online. You can easily complete IRS forms, add electronic signatures, and even collaborate with your accountant, all in one platform.

How do I fill out a tax form on pdfFiller?

Simply upload your form to pdfFiller or select it from the pdfFiller library, like the 1098 template. Use the editing tools to enter information directly onto the form, add checkmarks, and sign digitally. Once completed, you can save, download, or securely share the form.

Where do I enter IRS form 1098?

You report this mortgage interest from Form 1098 on Schedule E, not Schedule A. Also, you might have paid points when you took out the mortgage on your rental property.

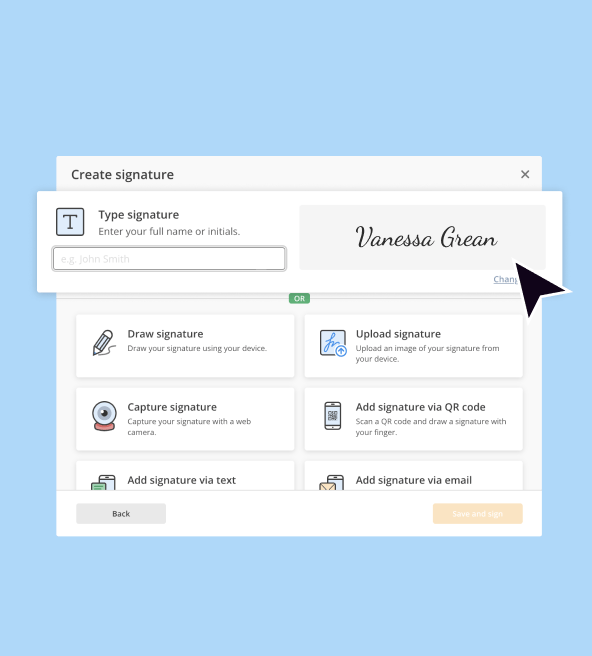

Can I eSign my tax documents on pdfFiller?

Yes, pdfFiller supports electronic signatures, which are legally recognized. You can sign your tax documents directly on the platform, saving time and eliminating the need for printing and scanning.

As a small business owner, do I need to submit Forms W-2 electronically?

Starting in 2024, businesses that file 10 or more information returns, including Forms W-2, are required to file electronically unless they receive an IRS waiver. The 10-return count includes various forms, such as 1098 form, 1099, 1095, and more. All employers are encouraged to submit Forms W-2 electronically. Forms W-2, whether submitted on paper or online, go to the Social Security Administration. For further filing details, visit SSA.gov/employer or call 800-772-6270.

How can I manage IRS form 1098 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your IRS form 1098 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I manage IRS form 1098 from Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the online PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your blank 1098 form in seconds.

How does Form 1098 benefit borrowers?

IRS Form 1098 helps borrowers claim the mortgage interest deduction, potentially lowering their taxable income if they itemize deductions on their tax return. The deduction can apply to interest paid on loans for a primary residence and sometimes a secondary home, subject to IRS guidelines.

What if the information on my 1098 mortgage interest forms is incorrect?

If you find errors on your Form 1098, such as an incorrect amount of interest or wrong property information, contact your lender immediately. They may need to file a corrected Form 1098 with the IRS, which can help avoid complications with your tax return.

Can I file my taxes directly through pdfFiller?

While pdfFiller provides all the tools to complete your forms, it does not offer direct tax filing services. Once your forms are completed, you can download and print them or upload them to an online tax filing service.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

very simple and useful but I would include some more functions

Great, easy and User friendly to the max.....thanks

Fill out Form 1098